tax rate in santa ana ca

The minimum combined 2022 sales tax rate for Santa Ana California is. Use the Property Tax Allocation Guide.

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes.

. Call me to find out the property tax on any home. Find Your Tax Rate. School Bond information is located on your property tax bill.

Identify a Letter or Notice. The Santa Ana sales tax rate is. Secured property generally refers to any property that can be used as collateral like land and mines.

15 for Santa Ana Tax. Did South Dakota v. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Santa Ana CA.

City of Santa Ana 925 City of Seal Beach 875 City of Stanton 875 City of Westminster 875 PLACER COUNTY 725 Town of Loomis 7. Within Santa Ana there are around 11 zip codes with the most populous zip code being 92704. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15 Special tax.

1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates. You can print a 925 sales tax table here. The average cumulative sales tax rate in Santa Ana California is 925.

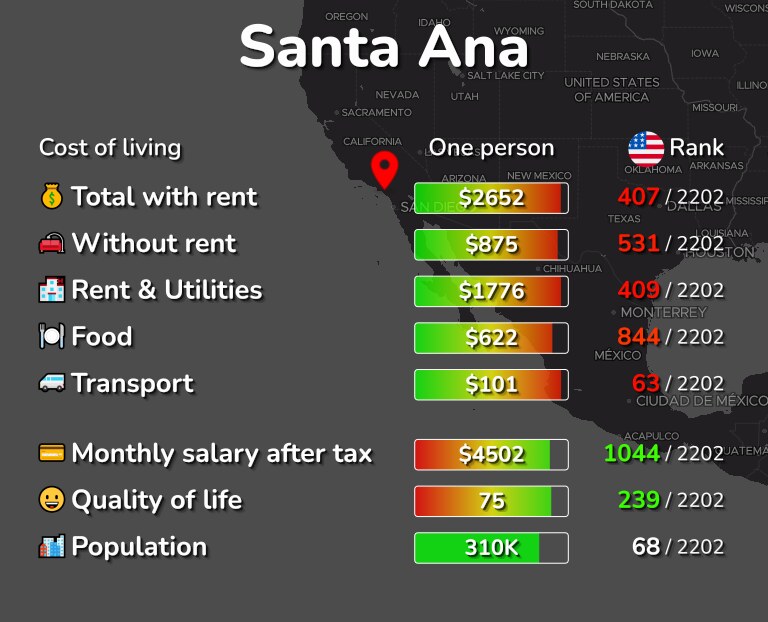

A combined city and county sales tax rate of 175 on top of Californias 6 base makes Santa Ana one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. You are advised to do your own research regarding property tax rates in Orange County CA and to also check for special assessments such as additional fees Mello Roos etc.

Here is a list of our partners and heres how we make money. The budgettax rate-determining process usually gives rise to customary public hearings to discuss tax rates and related budgetary questions. Santa Barbara campus rate is 775 8750.

This is the total of state county and city sales tax rates. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505. The current total local sales tax rate in Santa Ana CA is 9250.

The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943. The latest sales tax rates for cities starting with S in California CA state. The average sales tax rate in California is 8551.

Rates include state county and city taxes. These are the rates for taxes due in April 2021. In California your property tax rate may differ depending on whether your property is secured or unsecured.

05 for Countywide Measure M Transportation Tax. 925 Highest in Orange County 725 for State Sales and Use Tax. Santa Ana must adhere to provisions of the California Constitution in levying tax.

The latest sales tax rate for Santa Ana CA. 2020 rates included for use while preparing your income tax deduction. The California sales tax rate is currently 6.

The Orange County sales tax rate is 025. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Register for a Permit License or Account.

What is the sales tax rate in Santa Ana California. A 1 mental health services tax applies to income. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The County sales tax rate is. 10 12 22 24 32 35 and 37. Method to calculate Santa Ana sales tax in 2021.

This is the total of state county and city sales tax rates. School District Bond Rate. For tax rates in other cities see California sales taxes by city and county.

025 lower than the maximum sales tax in CA. The minimum combined 2020 sales tax rate for Santa Ana California is 925. Santa Ana is located within Orange County California.

The sales tax rate does not vary based on. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Santa Ana CA. Keep in mind that under state law taxpayers can elicit a vote on proposed rate increases that exceed established limits.

Your bracket depends on your taxable income and filing status. The California sales tax rate is currently. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 9. California state tax rates are 1 2 4 6 8 93 103 113 and 123. Santa Ana CA Sales Tax Rate.

There are seven federal tax brackets for the 2020 tax year. This includes the sales tax rates on the state county city and special levels.

Food And Sales Tax 2020 In California Heather

Sales Tax In Orange County Enjoy Oc

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Orange County Ca Property Tax Calculator Smartasset

Find Recent Orange County Shark Sightings And Attacks On Google Maps Including Date Description Of Sighting And Or In 2022 Shark Basking Shark Baby Great White Shark

Mapsontheweb Kansas Missouri Los Angeles North Washington

California Sales Tax Guide For Businesses

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Who Pays The Transfer Tax In Orange County California

Orange County Property Tax Oc Tax Collector Tax Specialists